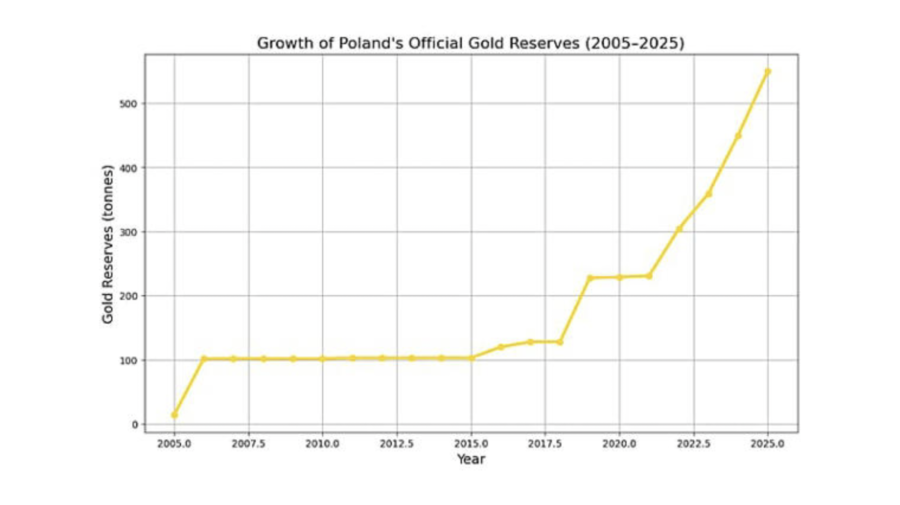

Poland’s central bank has confirmed plans to expand its gold reserves significantly, reinforcing the country’s long-term strategy of strengthening financial security and diversifying its reserves. The decision will see total holdings rise to 700 tonnes, positioning Poland among the world’s leading holders of monetary gold.

According to Narodowy Bank Polski, gold continues to play a key role as a strategic asset, offering resilience in times of geopolitical uncertainty and global market volatility. Increasing reserves is intended to enhance the credibility and stability of the national balance sheet while reducing reliance on foreign currencies.

Speaking about the move, central bank president Adam Glapiński emphasised that gold remains a cornerstone of sovereign financial security. He noted that recent years have seen a marked acceleration in gold purchases by central banks worldwide, reflecting broader concerns about inflation, global debt levels and geopolitical risk.

At present, Poland’s gold holdings stand at 550 tonnes, following substantial purchases made over the past year. The planned increase would elevate the country into the top tier of global gold-holding nations, underscoring its ambition to align reserve policy with that of the largest and most financially secure economies.

The decision is expected to be implemented gradually, subject to internal approvals, and forms part of a broader strategy aimed at safeguarding monetary stability over the long term.

When the purchase is concluded, gold will account for 28.22% Poland’s foreign exchange reserves.

Photo: Narodowy Bank Polski

Tomasz Modrzejewski